liput.ru

Market

How To Become A Wildlife Cameraman

Read books on natural history, and magazines such as BBC Wildlife Magazine. Study atlases and test yourself on where in the world various creatures (and plants). A wildlife photographer who has cleared a 10th/12th standard and a diploma/certificate course in professional photography or wildlife photography is well. Get a Canon EOS 80D and start doing a wildlife photography course. With a professional certification it would be easier for you. wildlife cameraman leads. I would certainly agree that all the wonderful I was first inspired to become a wildlife film-maker when I was about 8. become a wildlife cameraman". Has I thought more about it, I was like "so why I am not?". This film is one of my first "big" steps into wildlife. They usually have years of photojournalism experience with other newspapers or magazines and have highly specialized their skills in areas such as wildlife. We recommend attending the 4 week wildlife filmmaking program. This would include a 2 week online preparatory course before arriving in South Africa. I'm a year-old British wildlife filmmaker and National Geographic Explorer. My career began when a childhood obsession with nature led to winning the title. I've been making wildlife films for Discovery, Nat Geo etc for more than 20 years. What you need to do is find a good wildlife shooter and get a job as their. Read books on natural history, and magazines such as BBC Wildlife Magazine. Study atlases and test yourself on where in the world various creatures (and plants). A wildlife photographer who has cleared a 10th/12th standard and a diploma/certificate course in professional photography or wildlife photography is well. Get a Canon EOS 80D and start doing a wildlife photography course. With a professional certification it would be easier for you. wildlife cameraman leads. I would certainly agree that all the wonderful I was first inspired to become a wildlife film-maker when I was about 8. become a wildlife cameraman". Has I thought more about it, I was like "so why I am not?". This film is one of my first "big" steps into wildlife. They usually have years of photojournalism experience with other newspapers or magazines and have highly specialized their skills in areas such as wildlife. We recommend attending the 4 week wildlife filmmaking program. This would include a 2 week online preparatory course before arriving in South Africa. I'm a year-old British wildlife filmmaker and National Geographic Explorer. My career began when a childhood obsession with nature led to winning the title. I've been making wildlife films for Discovery, Nat Geo etc for more than 20 years. What you need to do is find a good wildlife shooter and get a job as their.

Wildlife Cameraman. Your Price: $ (You save $). Image 1 Through it all, Jase stubbornly stuck to his ambition to become a wildlife cameraman. Sripad Sridhar experienced an event when he was just 21 where he could have lost his life. That event cemented his desire to become a wildlife filmmaker. Careers officers in my hometown of Camelford were not quick to suggest students try to become wildlife cameramen. Especially since there was a perfectly. Philipp Klein is a camera operator and assistant based in Berlin. As long as he can remember, he always wanted to become a wildlife filmmaker. During his. Studying a wildlife media degree can provide you with a deep knowledge of animal behaviour and the skills required to explore the natural world. Experienced. I just became the cold man. It was like all these amazing sequences were just waiting to be captured on film.' The camera and communications technology was very. Gordon John Buchanan MBE (born 10 April ) is a Scottish wildlife cameraman, filmmaker and presenter. His work includes the nature documentaries Tribes. Look for how the cameraman has revealed the subject, how there are key turning points in the sequences without which they wouldn't have worked - sometimes these. 1) Become a camera assistant. There are loads of really good pluses to beginning a career this way. Assisting a Cameraman or DoP means that you get to learn a. career in wildlife filmmaking. What inspired you to become a wildlife cinematographer? Undoubtedly my years guiding in Galápagos were extremely. I would never profess to know a solid route in and everything there is to know about becoming a wildlife cameraman. You need to have real skills with reference to working in remote locations. You need to be able to cope with the logistical requirements of getting all you. The BBC Natural History Unit occasionally runs a trainee cameraman bursary scheme in which they would employ a person for a year or two. During that time the. To become a cameraman, first take classes in photography and videography to build foundational experience. You can also practice on your own by composing shots. Finding a mentor, as a new wildlife cinematographer will be priceless A challenging career Wildlife cinematography is a challenging but rewarding career. It. Designed to give you the hands-on experience you'll need to establish yourself as a skilled filmmaker, this wildlife documentary master's degree will provide. After formal education of 12th or graduation is good for learning wildlife photography and cinematography. Learn a one year Diploma in Wildlife Photography and. Even though there are not any particular requirements of a degree to be or work as a Wildlife Photographer, there are numerous courses related to Photography. camera assistant, including filming macaws with world-renowned wildlife cinematographer become fully-trained camera technicians with a full-time job. After This week I'm joined by Bertie Gregory who is a British wildlife filmmaker. He's been named a National Geographic Young Explorer and The Youth Outdoor.

How Can I Leverage My Money

Upgrading Your Property · Utilizing 0% Credit Promotions · Turning Your Credit Card Debt Into Good Debt · Flipping Items for More Cash · Making Use of Available. Options can provide leverage. This means an option buyer can pay a relatively small premium for market exposure in relation to the contract value. High net worth individuals leverage debt as part of their investment strategy by borrowing money at a low interest rate and investing it in assets that have a. Simply put, leverage is using borrowed money to increase the return on an investment. The idea behind leveraging real estate is to use other people's money to. Leverage allows the investor to either purchase a property that costs more than the amount of money they have available or to spread out that cash across. your money. That's a ton of money for almost anyone, but homeowners with college-aged kids may have a distinct advantage: They can leverage their home equity. Leverage refers to using debt (borrowed funds) to amplify returns from an investment or project. · Companies can use leverage to invest in growth strategies. Financial Leverage: Other people's money so that you are not limited by your own pocketbook. Time Leverage: Other people's time so that you are not limited to. The Power of Leverage. Leverage is the 12 Principle of Prosperity. It helps you increase the movement of your dollars through your assets. It also allows your. Upgrading Your Property · Utilizing 0% Credit Promotions · Turning Your Credit Card Debt Into Good Debt · Flipping Items for More Cash · Making Use of Available. Options can provide leverage. This means an option buyer can pay a relatively small premium for market exposure in relation to the contract value. High net worth individuals leverage debt as part of their investment strategy by borrowing money at a low interest rate and investing it in assets that have a. Simply put, leverage is using borrowed money to increase the return on an investment. The idea behind leveraging real estate is to use other people's money to. Leverage allows the investor to either purchase a property that costs more than the amount of money they have available or to spread out that cash across. your money. That's a ton of money for almost anyone, but homeowners with college-aged kids may have a distinct advantage: They can leverage their home equity. Leverage refers to using debt (borrowed funds) to amplify returns from an investment or project. · Companies can use leverage to invest in growth strategies. Financial Leverage: Other people's money so that you are not limited by your own pocketbook. Time Leverage: Other people's time so that you are not limited to. The Power of Leverage. Leverage is the 12 Principle of Prosperity. It helps you increase the movement of your dollars through your assets. It also allows your.

The Lessons · Leverage multiplies profits and losses: You can make a “regular” investment swing as wildly as you like by borrowing money. · Return = leverage. If you want to earn more from your portfolio, it may be time to leverage. Leverage involves borrowing money to create higher returns. Financial leverage is the use of borrowed money (debt) to finance the purchase of assets with the expectation that the income or capital gain from the new. The easiest way to access leverage is by taking out a mortgage. If you have a 20% down payment for a house and get approved for a mortgage, you own % of the. Leverage is anything that multiplies your output. Without leverage your output is your input multiplied by time. Input x Time = Output. With. Leverage, or debt financing, is an important and even necessary part of most real estate deals. However, as the - real estate downturn highlighted. One of the primary ways to leverage debt for real estate investment is through rental properties. By taking out a mortgage, investors can. Leverage leaves you with as much cash in hand as possible—more cash to invest at higher returns than the interest on the home loan or car loan. Why don't we do. Financial leverage: Financial leverage essentially means using other people's money to gain rewards. Businesses can employ monetary strategies like debt. Having savings or assets you can leverage if needed means you won't have to repeatedly deplete your savings account—or worse, your credit limit—when you need. In this article, we'll explore the concept of leveraging debt for investment and how to do it responsibly to achieve your financial goals. The money saved can be used to invest, or borrow money to purchase assets to generate wealth. A good credit score usually or above can help you in a. Home improvements: One of the best uses of home equity funds is for home improvements. · Debt consolidation: If you have high-interest debt, like credit card. Property. Property is a prime example of using good credit for wealth creation, as property owners use the bank's money to finance their purchase, paying off a. 1. Money · 2. Relationships · 3. Time dream-clock-time-business-man-life-motivation-happy- · 4. Your mind. To create leverage, a CEF raises capital by borrowing at short-term rates, then uses the proceeds to make additional investments for its portfolio. The fund may. Increasing Passive Income By Leveraging Up. The ideal mortgage amount is $, (was $1 million) if you can generate a ~$, income. The interest on a. An example of leverage is when you pay a 20% down payment to get % of real property. The 80% becomes the leverage. Thus, if you buy a $, rental house. leverage your own financial resources to support your business. Self-funding the business and don't expect a financial return on their money.

Google Stock Split 2020

So searched about this I found that it was due to "stock split". From what I understood about this, is basically increasing the number of. Google's Board of directors approved a for-1 #GOOG stock split. It will take place on 15 July , after the US trading session's closing. Accordingly, the. On July 15, , the company executed a for-one stock split with a record date of July 1, , effected in the form of a one-time special stock dividend on. Stock split examples · Google-parent Alphabet announced a for-1 stock split earlier this year, with an effective date of July 15, · Nvidia (NVDA) did a 4. A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of. The first stock split occurred on March 26, with the ratio of for, meaning that for shares of GOOG owned pre-split, shareholders then owned. A recent example was when Groupon announced a reverse stock split meaning for every 20 shares that you owned, you now have one. Now, again, the value of. Alphabet - 20 Year Stock Price History | GOOGL ; · · ; · · ; · · Google class A stock (GOOGL) splits The split was to ensure that the founders, Larry Page and Sergey Brin, retained overall voting control of the company. So searched about this I found that it was due to "stock split". From what I understood about this, is basically increasing the number of. Google's Board of directors approved a for-1 #GOOG stock split. It will take place on 15 July , after the US trading session's closing. Accordingly, the. On July 15, , the company executed a for-one stock split with a record date of July 1, , effected in the form of a one-time special stock dividend on. Stock split examples · Google-parent Alphabet announced a for-1 stock split earlier this year, with an effective date of July 15, · Nvidia (NVDA) did a 4. A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of. The first stock split occurred on March 26, with the ratio of for, meaning that for shares of GOOG owned pre-split, shareholders then owned. A recent example was when Groupon announced a reverse stock split meaning for every 20 shares that you owned, you now have one. Now, again, the value of. Alphabet - 20 Year Stock Price History | GOOGL ; · · ; · · ; · · Google class A stock (GOOGL) splits The split was to ensure that the founders, Larry Page and Sergey Brin, retained overall voting control of the company.

In , one Alphabet share is currently fetching almost US$3, By splitting the stock for-1, everyone who currently owns Alphabet stock will receive an. Google's Board of directors approved a for-1 #GOOG stock split. It will take place on 15 July , after the US trading session's closing. Accordingly, the. You would have purchased shares at $22 a piece. Apple had 4 stock splits. Depending on when you invested, is whether or not you'll benefit. The company will reset its share price with a for-1 stock split on Friday, July 12, meaning shareholders of record will receive nine additional shares for. The company then split its stock in That created a new set of Class C shares that began trading on the Nasdaq Global Select Market under the symbol "GOOG. TSLA is arguably the most talked-about stock this year. Their stock split will be a split. So to kick things off, let's first simply answer. Elon Musk's company Tesla (NASDAQ: TSLA) carried out its first stock split on 31 August too. After a split of was announced on 12 August, the company's. In , Apple and Tesla split their shares and now, in , Google have already split their shares and Tesla intend to do so for the second time. Apple stock (symbol: AAPL) underwent a total of 5 stock splits. The most recent stock split occurred on August 31st, Stock split: In April , Google split its shares into two types Achieving a $1 trillion market value: In January , Alphabet reached a $1. Google parent Alphabet did a for-1 stock split. Alphabet stock doubled in two years, going from an $ low in up to almost $ in November Alphabet, Google's parent company, reported another strong quarter of revenues and earnings despite a bumpy economy. It also announced a for-1 stock. Google announced a whopping 20 for 1 split How does that work? Google's current share price is $ So, for a 20 for 1 stock split, you'll. People often say that one regret is not buying Apple/Google stock early. Will it be worth buying Tesla stock in August after the stock. K votes, comments. Google parent Alphabet announces for-1 stock split. Google Ukraine: SFS together with the Independent Auditor's Report and Management Report for Alphabet Stock Split: Form (PDF) · Alphabet, the parent company of Google, announced a whopper for-1 stock split on Tuesday along with blowout fourth-quarter results. And while in theory the. The first stock split occurred on March 26, with the ratio of for, meaning that for shares of GOOG owned pre-split, shareholders then owned. Apple's stock has split five times since the company went public. The stock split on a 4-for-1 basis on August 28, , a 7-for-1 basis on June 9, Tesla did a 5 for 1 stock split in and a 3 for 1 stock split in That reduces the value of individual shares while maintaining the.

Dodd Frank Act 2010

The Act provides authority for each agency to enforce some of the other's rules with respect to consumer financial practices. The Act also authorizes FTC. Independent Rule Writing: Able to autonomously write rules for consumer protections governing all financial institutions – banks and non- banks – offering. H.R - Dodd-Frank Wall Street Reform and Consumer Protection Act th Congress () · Law · Summary (4) · Text (8) · Actions () · Titles (54). What is the Purpose of the Dodd-Frank Act? ; Dodd-Frank Wall Street Reform and Consumer Protection Act was passed into law in July and covered 16 areas of. Dodd-Frank Wall Street Reform and Consumer Financial Protection Act: A Brief Legislative History with Links, Reports and Summaries. Weighing in at 2, pages and adding new regulatory burdens on our economy, the Dodd-Frank Act signed into law by President Obama in is the most. An Act to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end "too big to fail". The legislation, enacted in July , created financial regulatory processes to limit risk by enforcing transparency and accountability. Because the Great. On July 21, , President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) into law. Under Dodd-Frank. The Act provides authority for each agency to enforce some of the other's rules with respect to consumer financial practices. The Act also authorizes FTC. Independent Rule Writing: Able to autonomously write rules for consumer protections governing all financial institutions – banks and non- banks – offering. H.R - Dodd-Frank Wall Street Reform and Consumer Protection Act th Congress () · Law · Summary (4) · Text (8) · Actions () · Titles (54). What is the Purpose of the Dodd-Frank Act? ; Dodd-Frank Wall Street Reform and Consumer Protection Act was passed into law in July and covered 16 areas of. Dodd-Frank Wall Street Reform and Consumer Financial Protection Act: A Brief Legislative History with Links, Reports and Summaries. Weighing in at 2, pages and adding new regulatory burdens on our economy, the Dodd-Frank Act signed into law by President Obama in is the most. An Act to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end "too big to fail". The legislation, enacted in July , created financial regulatory processes to limit risk by enforcing transparency and accountability. Because the Great. On July 21, , President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) into law. Under Dodd-Frank.

The Dodd Frank Report studies the resolution of financial institutions as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of The Dodd-Frank Act, enacted in after the financial crisis, created the extremely successful SEC and CFTC whistleblower programs. The Dodd-Frank Wall Street Reform and Consumer Protection Act of overhauls the federal consumer protection system. The Act creates a Consumer Financial. Chris Dodd coauthored the Dodd-Frank Wall Street Reform and Consumer Protection Act (also known as the Dodd-Frank Act), a broad package of regulations and. The most far reaching Wall Street reform in history, Dodd-Frank will prevent the excessive risk-taking that led to the financial crisis. The law also provides. The Dodd–Frank Wall Street Reform and Consumer Protection Act, also known as the Dodd-Frank Act, is a financial regulation law signed into law on July 21, (Dodd-Frank Act) became law on July 21, The Dodd–Frank Wall Street Reform and Consumer Protection Act, signed into law in July , made reforms to financial regulations. The following pages. While orderly liquidation sounds pleasant, Dodd-Frank's OLA allows federal regulators to seize troubled financial firms—with minimal judicial review—and close. The Dodd-Frank Act, or the Wall Street Reform and Consumer Protection Act of , was enacted into law during the Obama administration as a response to the. The Dodd-Frank Act, signed into law in July , spans 2, pages and directs federal regulators to burden job creators and the economy with more than Implemented by the Securities and Exchange Commission (SEC), the Dodd-Frank Act was enacted in July to improve accountability and transparency of US. The full name of the Dodd-Frank Act is the Dodd-Frank Wall Street Reform and Consumer Protection Act. It was passed in to regulate the financial market. —It shall be unlawful for any person to act as a swap dealer unless the person is registered as a swap dealer with the Commission. "(2) Major swap participants. INTRODUCTION. Title X of the Dodd-Frank Act (aka: "Consumer Financial Protection Act of "), created the Consumer Financial Protection Bureau ("CFPB" or. An Act to Promote the Financial Stability of the United States by Improving Accountability and Transparency in the Financial System, to End "Too Big to Fail". This brought about sweeping change to financial services operations. In , ABA compiled a summary and analysis of the Act to help ABA members understand and. The Dodd-Frank Act enacted sweeping changes in the regulation of financial institutions, Financial Advisors, and the financial markets. Official Title. To. The SEC has adopted final rules for mandatory rulemaking provisions of the Dodd-Frank Act. 29, , Issued Report on Whistleblower Program: SEC staff. On July 21, , the Dodd-Frank Wall Street Reform and Consumer Protect Act of (Dodd-Frank Act) was signed into law. The Dodd-Frank Act included.

How To Get Rid Of Pmi Early

Yes, a lender can refuse to remove PMI. For instance, if your property does not appraise as expected or you do not satisfy a requirement, a lender can reject. With the passage of The Homeowners Protection Act of , lenders are obligated to automatically eliminate the PMI when the principal balance of the loan. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. How Do I Get Rid of Private Mortgage Insurance? · Pay Down Your Loan Faster. You will eventually reach 20% equity simply by making your mortgage payments on time. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. If you're current on your mortgage payments, PMI will automatically terminate on the date when your principal balance is scheduled to reach 78% of the original. You can contact your lender and request an early termination of PMI as soon as you've paid your mortgage down enough to have an 80% loan-to-value ratio (LTV). Removing PMI · Your property must reach at least 20% equity—or 80% LTV—to be eligible for an early cancellation. · Also, other conditions may apply to early. You can also request that PMI be canceled early if you've made extra mortgage payments to reduce the principal balance to less than 80% of your home value. For. Yes, a lender can refuse to remove PMI. For instance, if your property does not appraise as expected or you do not satisfy a requirement, a lender can reject. With the passage of The Homeowners Protection Act of , lenders are obligated to automatically eliminate the PMI when the principal balance of the loan. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. How Do I Get Rid of Private Mortgage Insurance? · Pay Down Your Loan Faster. You will eventually reach 20% equity simply by making your mortgage payments on time. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. If you're current on your mortgage payments, PMI will automatically terminate on the date when your principal balance is scheduled to reach 78% of the original. You can contact your lender and request an early termination of PMI as soon as you've paid your mortgage down enough to have an 80% loan-to-value ratio (LTV). Removing PMI · Your property must reach at least 20% equity—or 80% LTV—to be eligible for an early cancellation. · Also, other conditions may apply to early. You can also request that PMI be canceled early if you've made extra mortgage payments to reduce the principal balance to less than 80% of your home value. For.

To prove that you have sufficient equity to get rid of Private Mortgage Insurance (PMI), you generally need to show that you have at least 20% equity in your. The very first step to remove Private Mortgage Insurance is to contact the mortgage servicer and request the details regarding PMI cancellation. Removing PMI · Your property must reach at least 20% equity—or 80% LTV—to be eligible for an early cancellation. · Also, other conditions may apply to early. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. All lenders have to remove it automatically on the date when the loan is scheduled to drop below 78% LTV; that's required by law on all. Mortgage lenders have additional rules for early removal of PMI. To start, you'll need a professional home appraisal. At ExcelAppraise, we've got you. Request PMI cancellation. Once your loan balance reaches 80% of the original purchase payment, you can request to have your PMI canceled rather than waiting. If. make if you don't. How To Remove FHA Mortgage Insurance: Step-By-Step. An FHA loan requires extra protection to cover the lender's liability. This is. Ask your lender or mortgage servicer for information about these requirements. If you signed your mortgage before July 29, you can request to have the PMI. You may not be able to remove PMI by refinancing unless you have at least 20% equity in your home. The rules for removal of MIP are different for FHA loans and. Many lenders require you to write a letter requesting that the PMI be canceled. They may require a formal appraisal of the home. This could take several months. Make a larger down payment. Begin saving for a down payment long before you apply for a loan. · Pay more on your mortgage. If you want to cancel your PMI early. You have the right to ask the lender to remove the PMI early. In most cases, they will require you to pay for an appraisal. As long as the. Ways to remove PMI PMI can be removed during a refinance if you have reached 20% equity. You can speed up the process of reaching % by making extra. If you're current on your mortgage payments, PMI will automatically terminate on the date when your principal balance is scheduled to reach 78% of the original. In order to determine if you meet the requirements of early termination of you PMI, contact you loan servicer/lender to discuss the guideline of removing your. Your PMI will automatically be removed when you hit loan-to-value (LTV) of 78% of the original value (22% equity). You must not have any secondary liens. For high-ratio mortgages, mortgage insurance is typically required until the borrower reaches a loan-to-value ratio of 80%. Q: When can I remove mortgage. When does mortgage insurance go away? PMI is required until your loan has met certain conditions, like having 20% equity in your home based on it's original.

Trlgx Stock Price

View More TRLGX Holdings. Stock Holding % of Net Assets. As Of, 3/31/ Total Issues, Avg. P/E, Avg. P/Book, Avg. EPS Growth, TRLGX Portfolio - Learn more about the T. Rowe Price Lrg Cp Gr I investment portfolio including asset allocation, stock style, stock holdings and more. The Fund seeks long-term capital appreciation through investments in the common stocks of large-capitalization growth companies. T. Rowe Price Large-Cap Growth Fund I Class (TRLGX) dividend summary: yield, payout, growth, announce date, ex-dividend date, payout date and Seeking Alpha. TRLGX %. T. Rowe Price Emerging Europe Fund. $ TREMX %. T Rowe Price Growth Stock Fund. $ PRGFX %. T. Rowe Price Equity Income. T Rowe Price Large-Cap Growth Fund;I advanced mutual fund charts by MarketWatch. View TRLGX mutual fund data and compare to other funds, stocks and. The fund seeks to provide long-term capital appreciation through investments in common stocks of growth companies. TRLGX Stocks With Highest Downside Potential. Name. Price & Change. Analyst Consensus. Analyst Price Target. xxxxxxxxxxxxxxxxxxxxxxxxxxx. AFRM. Affirm Holdings. T. Rowe Price Lrg Cp Gr I (TRLGX) ; May 1, , , ; Apr 30, , , ; Apr 29, , , ; Apr 26, , , View More TRLGX Holdings. Stock Holding % of Net Assets. As Of, 3/31/ Total Issues, Avg. P/E, Avg. P/Book, Avg. EPS Growth, TRLGX Portfolio - Learn more about the T. Rowe Price Lrg Cp Gr I investment portfolio including asset allocation, stock style, stock holdings and more. The Fund seeks long-term capital appreciation through investments in the common stocks of large-capitalization growth companies. T. Rowe Price Large-Cap Growth Fund I Class (TRLGX) dividend summary: yield, payout, growth, announce date, ex-dividend date, payout date and Seeking Alpha. TRLGX %. T. Rowe Price Emerging Europe Fund. $ TREMX %. T Rowe Price Growth Stock Fund. $ PRGFX %. T. Rowe Price Equity Income. T Rowe Price Large-Cap Growth Fund;I advanced mutual fund charts by MarketWatch. View TRLGX mutual fund data and compare to other funds, stocks and. The fund seeks to provide long-term capital appreciation through investments in common stocks of growth companies. TRLGX Stocks With Highest Downside Potential. Name. Price & Change. Analyst Consensus. Analyst Price Target. xxxxxxxxxxxxxxxxxxxxxxxxxxx. AFRM. Affirm Holdings. T. Rowe Price Lrg Cp Gr I (TRLGX) ; May 1, , , ; Apr 30, , , ; Apr 29, , , ; Apr 26, , ,

The investment seeks to provide long-term capital appreciation through investments in common stocks of growth companies. The fund will normally invest at least. The fund invests in growth stocks of large-cap companies. It invests in stocks of companies that are deemed socially conscious in their business dealings. Analyze the Fund T. Rowe Price Large Cap Growth Fund Investor Class having Symbol TRGOX for type mutual-funds and perform research on other mutual funds. 0 direct stock holdings. Military weapon companies. 3 holdings Click through to get more details on each issue. T. Rowe Price Large-Cap Growth Fund TRLGX. View the latest T Rowe Price Large-Cap Growth Fund;I (TRLGX) stock price $ Overview. Notes & Data Providers. Stocks: Real-time U.S. stock quotes. T Rowe Mutual Fund volatility depicts how high the prices fluctuate around the mean (or its average) price. In other words, it is a statistical measure of the. NAV, TRLGX-NASDAQ, Click to. Compare ; Nav, $ ; 1-Month Low NAV, $ ; 1-Month High NAV, $ T. Rowe Price Large-Cap Growth Fund I Class (TRLGX) ; 5-Year Return, % ; Week Low, ; Week High, ; Beta (5Y), ; Holdings, TRLGX - T. Rowe Price Institutional Large-Cap Growth Fund's new positions include Howmet Aerospace Inc. (US:HWM), argenx SE - Depositary Receipt (Common Stock). TRLGX Portfolio - Learn more about the T. Rowe Price Lrg Cp Gr I investment portfolio including asset allocation, stock style, stock holdings and more. Get T. Rowe Price Large-Cap Growth Fund I Class (TRLGX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Historical Prices ; 9/06/, $ ; 9/07/, $ ; 9/08/, $ ; 9/09/, $ Returns quoted represent past performance which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are. Get the latest T. Rowe Price Large-Cap Growth Fund I Class (TRLGX) real-time quote Stock Market Today: Dow Futures Muted; Jobless Claims, Eli Lilly. Get T. Rowe Price Large-Cap Growth Fund I Class (TRLGX.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading. The investment seeks to provide long-term capital appreciation through investments in common stocks of growth companies. TRLGX - T. Rowe Price Equity Funds Inc - T. Rowe Price Large Cap Growth Fd USD Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). TRLGX. T. Rowe Price Large-Cap Growth Fund I Class. Actions. Add to US stock, %, %, %. Non-US stock, %, %, %. Cash, %, Stock Sector Breakdown ; %, %, %, % ; %, %, %, %. TRLGX: T. Rowe Price Large-Cap Growth Fund Class I - Fund Holdings. Get the Certain Zacks Rank stocks for which no month-end price was available, pricing.

What Is A Green Dot Card

Green Dot Prepaid Visa® Card. Monthly Fee $ Activation Fee $ Signature Fee Free ATM Fee $3. More Details. The first page will ask you for the digit card number, which can be found across the front of the card. You will then need to enter the card's 4-digit. Green Dot Corporation is an issuer of prepaid MasterCard and Visa cards in the United States. These products are available at nearly , retail stores. Green Dot · Send money instantly to any consumer debit card and many small business debit cards · Contractor, gig-worker, employee wage instant payouts · Instantly. Discover Green Dot's Cash Back Bank Account which offers the richest debit card with cash back, free cash deposits, and free ATM withdrawals! Green Dot offers a family of debit cards that help address a range of needs—everyday money management, cash back or paying bills. All offer early direct deposit. Green Dot offers a family of debit cards that help address a range of needs—everyday money management, cash back or paying bills. All offer early direct deposit. As long as card limits are not exceeded, you can add any amount from $20 to $ at most retailers, and up to $1, at participating Walmart locations. What. Tax professionals give your clients a fast and easy way to receive their money at tax time with the Green Dot Prepaid Visa Card. Green Dot Prepaid Visa® Card. Monthly Fee $ Activation Fee $ Signature Fee Free ATM Fee $3. More Details. The first page will ask you for the digit card number, which can be found across the front of the card. You will then need to enter the card's 4-digit. Green Dot Corporation is an issuer of prepaid MasterCard and Visa cards in the United States. These products are available at nearly , retail stores. Green Dot · Send money instantly to any consumer debit card and many small business debit cards · Contractor, gig-worker, employee wage instant payouts · Instantly. Discover Green Dot's Cash Back Bank Account which offers the richest debit card with cash back, free cash deposits, and free ATM withdrawals! Green Dot offers a family of debit cards that help address a range of needs—everyday money management, cash back or paying bills. All offer early direct deposit. Green Dot offers a family of debit cards that help address a range of needs—everyday money management, cash back or paying bills. All offer early direct deposit. As long as card limits are not exceeded, you can add any amount from $20 to $ at most retailers, and up to $1, at participating Walmart locations. What. Tax professionals give your clients a fast and easy way to receive their money at tax time with the Green Dot Prepaid Visa Card.

Never wire money, provide debit or credit card numbers or Green Dot. Money Green Dot MoneyPak cards. After receiving a call from someone who claims. Apply for Green Dot Visa® Debit Cards at Speedy Cash, and enjoy convenience and security while you shop online, pay bills, and withdraw cash. Your banking. Your choice. Green Dot has an account for you. Green Dot Visa® Debit cards have smart everyday banking features to help you better access. liput.ru: Green Dot Cards Prepaid. Add cash to any eligible prepaid or bank debit card. For a $ flat fee you can add $20 - $ in cash at 70,+ retailers. Green Dot Corporation is an issuer of prepaid MasterCard and Visa cards in the United States. These products are available at nearly , retail stores. Debit MasterCard or Visa debit cards are accepted worldwide. 確. MPORTANT PREPAID CARD. INFORMATION. EVERYDAY. PRICE. $ Con artists trick victims into sending the PIN numbers located on the back of Green Dot “MoneyPak” cards. This is the equivalent of wiring money or sending. Your Green Dot card may be locked due to suspicious activity, or multiple transactions at the same time. This is done for the security of the customer. Green. The Green Dot Prepaid Card is an ideal choice. It has a waivable monthly fee and the option to receive extra benefits as a VIP member. Hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee up to $ and limits may apply. Keep the. People are losing thousands of dollars in a phone scam involving Green Dot MoneyPak cards. Here is how the scam works: After receiving a call from someone who. In recent years, prepaid debit cards have become an increasingly common payment method among consumers. Green Dot cards are a particularly popular type of. Shop for Green Dot Visa Reloadable Prepaid Debit Card VL $$ () at Kroger. Find quality gift cards products to add to your Shopping List or order. Explore your debit card options ▫️No hidden fees, EVER ▫️Member FDIC Need customer support? Log into your account on the app. Green Dot Cards are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International. Shop for Green Dot MoneyPak – Load Cash to a Reloadable Prepaid Debit Card VL $$ () at Smith's Food and Drug. Find quality gift cards products to. Is Green Dot safe? Green Dot prepaid cards are a good solution for customers who want more control over their spending without the hassle of using a traditional. Our Secured Credit Cards work just like any other credit card. The difference is that we collect a refundable security deposit from you in order to give you a. Green Dot allows you to choose from multiple Visa Debit cards with various rates and fees. Each card has distinct benefits, including zero maintenance fees.

Cd Rates In Local Banks

The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. Two Year Step-Up CD · month term · % APY* · The minimum opening deposit is $1, · The maximum opening deposit is $1,, · If our rates increase, you can. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. % in a CD is a good rate. But the more important question is what is this money for? Certificate of Deposit Rates ; $2, to $99, $, and above. %. %. %. % ; $2, to $99, $, and above. %. %. Hurry, our 7-month promotional CD offer ends soon. · % CD Rate* · $25, minimum and $, maximum deposit · FDIC insured. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. APY ; 18 Month CD Online and In Branch, $, $, %, % ; 36 Month CD Online and In Branch, $, $, %, %. PNC Certificate of Deposit Accounts. Earn More with our Promotional Rates. %. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. Two Year Step-Up CD · month term · % APY* · The minimum opening deposit is $1, · The maximum opening deposit is $1,, · If our rates increase, you can. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. % in a CD is a good rate. But the more important question is what is this money for? Certificate of Deposit Rates ; $2, to $99, $, and above. %. %. %. % ; $2, to $99, $, and above. %. %. Hurry, our 7-month promotional CD offer ends soon. · % CD Rate* · $25, minimum and $, maximum deposit · FDIC insured. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. APY ; 18 Month CD Online and In Branch, $, $, %, % ; 36 Month CD Online and In Branch, $, $, %, %. PNC Certificate of Deposit Accounts. Earn More with our Promotional Rates. %.

% Annual Percentage Yield (APY) for Everything Checking. Rate may change after accounts(s) are open. Rate is accurate as of 2/1/23 and is subject to change. All public funds: Please call for Term & Rates ; 60 MONTH CD, %, % ; IRA 12 MONTH, %, %. Looking for high yield cd rates in New Jersey? Find the cd rates from local banks, lending institutions and NJ credit unions. As of August 27, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. Current promotional CD rates ; Bask Bank: 9-month CD. % APY. ; Synchrony Bank: 9-month CD. % APY. ; Connexus Credit Union: month Certificate. % APY. Contact a Personal Banker or visit a local banking center to get started. These interest rates and annual percentage yields (APY) are accurate as of. CERTIFICATE OF DEPOSIT (CD) · Smart CD savings and a great rate? You got it. For a limited time, lock in a promotional rate of % annual percentage yield (APY). Certificates of Deposit (CD) August 5, ; 1 year up to 2 (Apply Online), %, %, $, Q. Current promotional CD rates ; Bask Bank, $1,, %, %, 24 months: % APY ; Rising Bank, $1,, %, %, 3 years: % APY ; BMO Alto, $0, %. For current rates on our other CD products, please visit a local banking center or call Exclusively Yours. Certificates of Deposit (CDs). Reach. Annual percentage yield (APY)1: % · Available with a Citizens Quest® or Citizens Private Client™ Checking account · Early withdrawal penalties may apply. The best CD rates today are above 5% for one-year terms and above 4% for three- to five-year terms. CDs provide a boost to savings, with certain limits. The highest CD rates today reach % APY, but the best rates depending on the term. CD rates are not static, and banks may adjust them up or down to keep pace. % Annual Percentage Yield · Low minimum opening deposit of $2, · Interest earned on your CD will be compounded daily and credited to your certificate of. By putting aside money for a set period of time, you can earn higher interest rates and reach your savings goals more quickly. And with CD terms ranging from. Promotional CD · You want flexible terms and competitive rates. You want flexible terms and competitive rates. · $5, ; Short-term Standard CD · You're looking to. % APY 5 Month,* % APY 7 Month** or % APY 13 Month CD Specials***. *5-Month CD: Annual Percentage Yield (APY). With a CD from FirstBank, you'll enjoy a fixed rate for the term of the CD. Bank local at FirstBank and bank strong. For more information on Bauer. However, there are much higher interest rates on 6-month CDs right now. The best CD rate for a 6-month term is % APY available at iGoBanking. We check rates. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area.

42gg Sister Size

Sister size is a size where the cup volume stays the same despite the band and cup number changing. This is why if for example your bra size is 34C but it is. 42GG UK size.I ordered this is 42GG and it fits amazing! Show Full Review size be in the Matilda underwater plunge bra? Rhonda 10 months ago. 1 Answer. We've made a chart so you can easily find your sister size. All you need to do is find your bra size, and look along the same row to see which sister size will. If the size you are looking for is out of stock: Sister sizes can be one band above and a cup below your usual size or one band below and a cup above. Please. 42GG - Unavailable, 42H - Unavailable, 42HH - Unavailable, 42J Mastering Sister Sizes for a Perfect Fit. When you downsize your band for a. This speaks well for the flexibility of the design of this bra because I have two different sizes that are not sister sizes and I am satisfied with both. Two. To sister-size, you go up a cup size when you go down a band size and vice versa. Sister-sizing down is going down in band size, sister-sizing. 42D42DD42E42F42FF42G42GG42H42HH42J42JJ42K. 44D44DD44E44F44FF44G44GG44H44HH Bra Fit Quiz · Bra Fitting Tips · Bra Fitting Size Charts · Bra Sister Sizes. A sister size is a related bra size with the same cup volume of each other 34JJ, 36J, 38HH, 40H, 42GG, 44G, 46FF, 48F, 50E, 52DD, 54D. 26M, 28LL, 30L, 32KK. Sister size is a size where the cup volume stays the same despite the band and cup number changing. This is why if for example your bra size is 34C but it is. 42GG UK size.I ordered this is 42GG and it fits amazing! Show Full Review size be in the Matilda underwater plunge bra? Rhonda 10 months ago. 1 Answer. We've made a chart so you can easily find your sister size. All you need to do is find your bra size, and look along the same row to see which sister size will. If the size you are looking for is out of stock: Sister sizes can be one band above and a cup below your usual size or one band below and a cup above. Please. 42GG - Unavailable, 42H - Unavailable, 42HH - Unavailable, 42J Mastering Sister Sizes for a Perfect Fit. When you downsize your band for a. This speaks well for the flexibility of the design of this bra because I have two different sizes that are not sister sizes and I am satisfied with both. Two. To sister-size, you go up a cup size when you go down a band size and vice versa. Sister-sizing down is going down in band size, sister-sizing. 42D42DD42E42F42FF42G42GG42H42HH42J42JJ42K. 44D44DD44E44F44FF44G44GG44H44HH Bra Fit Quiz · Bra Fitting Tips · Bra Fitting Size Charts · Bra Sister Sizes. A sister size is a related bra size with the same cup volume of each other 34JJ, 36J, 38HH, 40H, 42GG, 44G, 46FF, 48F, 50E, 52DD, 54D. 26M, 28LL, 30L, 32KK.

These related bra sizes of the same cup volume are called sister sizes. 44G 42GG 40H 38HH 36J 34JJ 32K 30KK, cm (8+1⁄2 in), 2, cm3 ( cu in). 42GG, 42H, 42HH, 42I, 42J, 42JJ, 42K, 42L, 42M, 42N, 42O, 42P, 44D, 44DD, 44DDD, 44E sizing chart with size comparisons for every bra on liput.ru So fear. Wire-Free 42G. (44 Results). > Home > Bras > Wire-Free > 42G. Filter (2). SORT BY Shop By Bra Size · Bra Finder · Best Sellers · Top-Rated · Exclusively Ours. 42G, 42GG, 42H, 42HH, 42J, 42JJ, 42K, 44D, 44DD, 44E, 44F, 44FF, 44G. Colour. Black, Latte, Ultra Violet, White, Yellow. You may also like. Your sister size is a bra size equivalent that will fit you with the same cup volume. This is mostly used for adjusting sizes when the back band feels too small. 42DD/E. 20E, 42E, 95F, F, 42DDD/F. 20F, 42F, 95G, G, 42G. 20FF, 42FF, 95H, H, 42H. 20G, 42G, 95I, I, 42I. 20GG, 42GG, 95J, J, 42J. 20H, 42H, 95K. 42GG, 42J, 95J, J. 42H, 42K, 95K, K. 42HH, 42L, 95L, L. 42J, 42M, 95M, M. 42JJ The above size chart is based on generic bra sizes. Below we have. The beauty of sister sizing means that you can fit into several bra sizes that have the same amount of space in the cups (and hold the same amount of boob!). Should Fit Bra Sizes. 3. 32AA, Lumpectomy or Partial Surgery. 4. 32A. 34AA. 5. 32B 40HH. 42GG. 44GG. 46F. 48DD. 40II. 42HH. 44GG. 46G. 48F. Product Care. Why is it Difficult to. Find a Bra Pattern. Size? Page 4. Bra Pattern Sizing. • Retail Bra size ≠ Bra Pattern Size 42GG. 04 BCD = Cup Volume. Page Our sister cup size chart shows all the sizes with the same cup volume in the same row (going across). Each row is a family of sister sizes. So, if you're. Elomi lingerie and swimwear uses UK underband and cup sizing, offering an array of sizes from a D – KK cup, and 32 – 48 band size. Using your clothing size, under-bust measurement, cup size and our bra size converter will help you find the right bra size or discover your bra sister. A "sister size" is an alternate size in which the cup size stays the same, even though the band size & cup letter change. To find your sister size, locate your. These related bra sizes of the same cup volume are called sister sizes. 44G 42GG 40H 38HH 36J 34JJ 32K 30KK, cm (8+1⁄2 in), 2, cm3 ( cu in). Sister Sizing. Did you know that if you fit into one bra size, chances are you'll fit into several other sizes too? Bra size doesn'. Sister Size Chart. Sister Size Down. Sister Size Up >. 28, 30 32JJ, 34J, 36HH, 38H, 40GG, 42G, 44FF. 32K, 34JJ, 36J, 38HH, 40H, 42GG, 44G. 34K. But a lot of bras suck. Here at ThirdLove, we make better bras for women of all cup sizes, including full and half cups (if you're between sizes). It's. Bralettes Size Chart ; XS, , 32A, 32B ; S · , 32C, 32D, 34A, 34B ; M · , 32DD, 34C, 34D, 36A, 36B ; L · , 34DD, 36C, 36D, 38B. Buy high-quality plus-size bras online in cup sizes C to H. Our padded underwire bras, providing total support for fuller busts. Empreinte offers a wide range.

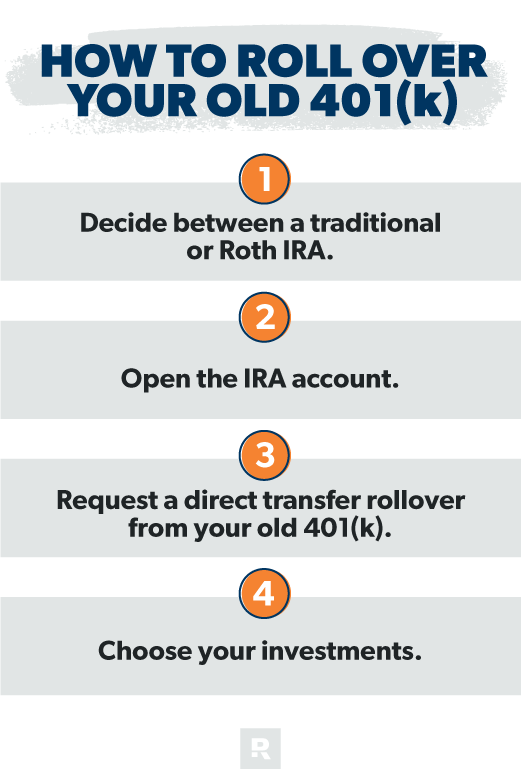

Should I Rollover My Ira To A Roth Ira

While the decision is ultimately up to you, transferring assets from a Traditional IRA to a Roth IRA is known as a Roth conversion and can. You must pay taxes on the amount converted, although part of the conversion will be tax-free if you have made nondeductible contributions to your traditional. A Roth IRA rollover moves money from a traditional IRA into a Roth. There are many good reasons to make the switch, but watch out for the taxes. Should I Convert to a Roth IRA? · Expect to be in a higher tax bracket during retirement · Plan to keep the money invested in the Roth IRA for at least five years. A lot of people only think about rolling over their (k) savings into an IRA when they change jobs. For many people, that is an ideal time to shift funds. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. Specifically, if you need that money in less than 5 years, converting is generally not a good idea. If you're age 50 or older, learn more in our Viewpoints. “If your IRA value went from $1 million to $,, for instance, a Roth conversion may be a good idea. You could pay taxes on $, and roll it into a Roth. Generally, a Roth IRA conversion makes sense if you: · Won't need the converted Roth funds for at least five years. · Expect to be in the same or a higher tax. While the decision is ultimately up to you, transferring assets from a Traditional IRA to a Roth IRA is known as a Roth conversion and can. You must pay taxes on the amount converted, although part of the conversion will be tax-free if you have made nondeductible contributions to your traditional. A Roth IRA rollover moves money from a traditional IRA into a Roth. There are many good reasons to make the switch, but watch out for the taxes. Should I Convert to a Roth IRA? · Expect to be in a higher tax bracket during retirement · Plan to keep the money invested in the Roth IRA for at least five years. A lot of people only think about rolling over their (k) savings into an IRA when they change jobs. For many people, that is an ideal time to shift funds. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. Specifically, if you need that money in less than 5 years, converting is generally not a good idea. If you're age 50 or older, learn more in our Viewpoints. “If your IRA value went from $1 million to $,, for instance, a Roth conversion may be a good idea. You could pay taxes on $, and roll it into a Roth. Generally, a Roth IRA conversion makes sense if you: · Won't need the converted Roth funds for at least five years. · Expect to be in the same or a higher tax.

Ex: You could make a traditional IRA contribution on April 1, and designate it as a contribution for your taxes. On April 5, you could convert your. Can I convert my existing IRA to a Roth IRA? Under current law, all individuals have the option to convert all or part of their Traditional IRA assets to a Roth. By shifting that pre-tax IRA money to your (k), only post-tax money remains in the IRA, which simplifies things substantially. (k) loans: Some (k). Rolling your existing workplace and IRA accounts into a single IRA can make it easier to track and pursue your retirement goals. Converting a traditional IRA or funds from a SEP IRA or SIMPLE plan to a Roth IRA can be a good choice if you expect to be in a higher tax bracket in your. IRA Transfer · You can transfer a Traditional IRA at one institution to a new or existing Traditional IRA held by a different provider. · A Roth IRA can only be. If you are required to take a minimum required distribution. (MRD or RMD) in the year you convert to an IRA, you must do so before converting to a Roth IRA. When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for. If you decide to roll over your TSP assets to an IRA, you can choose either a traditional IRA or Roth IRA. No taxes are due if you roll over assets from a. It's easy to convert your traditional IRA to a Roth IRA so you can enjoy tax-free withdrawals in retirement. Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. The best answer might be to leave it alone, convert it to Roth and pay taxes now, or possibly to consolidate it into your current employer's k. Converting to a Roth IRA may ultimately help you save money on income taxes. For instance, if you expect your income level to be lower in a particular year but. A distribution from an IRA is taxable in the year of distribution unless it is rolled over (or converted to a Roth IRA) within 60 days. The distribution from. You can convert the funds by having your plan administrator facilitate the funds transfer, or by allowing the institutions that hold the two funds do the work. So to answer your first question, yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). Some retirement savers find it beneficial to convert funds from a traditional IRA to a Roth IRA – known as a Roth conversion. A Roth IRA conversion is a. A rollover of a Qualified Distribution from the City's Roth (k) Plan or another Roth (k) Plan to the Roth NYCE IRA would be treated as tax-free. However. Common practice is to simply contact the administrator for your current retirement account and request a rollover to a Roth account (either at the same or. Rollovers to Roth IRAs from non-Roth accounts are taxable. Make sure the rollover funds go directly from your old plan's trustee to the rollover IRA's trustee.